5 things that helped me break into FP&A from Big 4 Audit / Industry Accounting

from Audit to Accounting to FP&A

CPA license

Industry accounting experience

Microsoft Excel skills

Business acumen and curiosity

Mentorship and executive buy-in

Two years into my career in Big 4 Audit, I was passed up for promotion to Audit Senior. This put a speed bump in my career goals… I did not want to suffer another 12 months during a pandemic as an “Audit Associate In-Charge” doing the same tasks with no changes to a bullet on my resume.

I had my career all planned out (like an Accountant would).

It was: Audit Associate > Audit Senior > Audit Manager > Controller > CFO.

The following five steps are how I broke off that path and found myself in Financial Planning & Analysis (FP&A).

1. CPA license

The CPA is the gold standard in Accounting & Finance as it is a test of commitment at national standards. Education, work experience, and extracurriculars can vary between professionals, but having a CPA is an apples-to-apples comparison.

Many newly appointed CPAs are frustrated they don’t get the raise, promotion, or bonus they expected at their job. That’s because being a CPA has little impact on your current role and the expectations you were hired for. The value is more evident when pivoting into new positions!

It is not a requirement, but it helped me stand out and “check the box” for job applications to get me into a Senior Accountant role and move to later jobs.

2. Industry accounting experience

Working as a Senior Accountant humbled me. I thought I knew everything, but I lacked so much.

The following four critical experiences in industry accounting helped prepare me for FP&A:

A) ERP systems experience - I learned how to navigate the ERP, understand tables and modules, create custom reports, and how transactions flow through each software used in the business.

B) Month-end closing - I learned the actual financial statement close process, the steps taken, and the importance of orchestrating the team and different departments to help close the books for monthly reporting.

C) 3-Statement Models - In my Senior Accountant Role, I prepared the eliminations/consolidations, balance sheets, and cash flow statements for monthly and annual reporting. Since I had this experience from audit, it was not difficult, but doing it in detail every month was a great exercise to witness the different variations and impacts our financial statements would report.

D) Actual vs. Budget variances - As the reporter of the actuals, I had to help support the details of monthly transactions and why they varied from the budget. This was my first step into helping the internal assurance team (we did not have a formal FP&A function), and I enjoyed it!

After a full year in this Senior Accountant / pseudo-Assistant Controller role, I had enough industry accounting experience for FP&A.

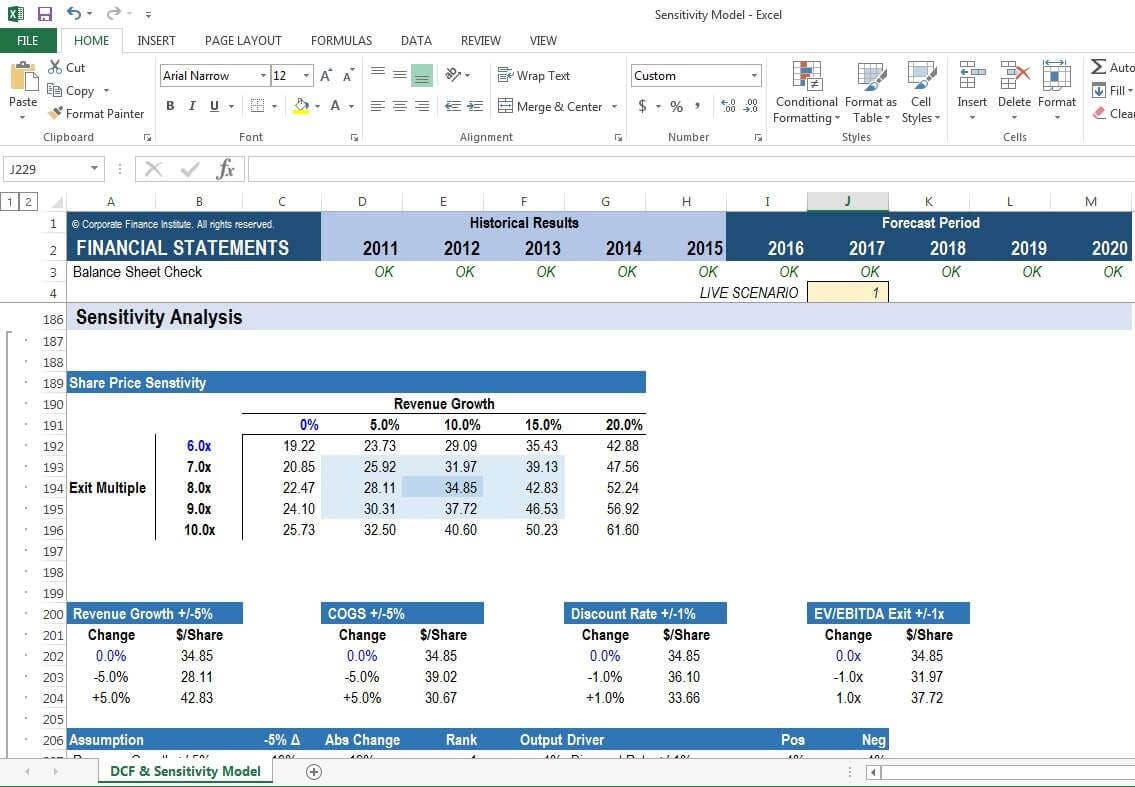

3. Microsoft Excel skills

Do you think you have “advanced Excel skills?” Well, pivot tables, =VLOOKUP, and named ranges are just halfway there.

After learning Power Query, Goal Seek, Data Tables, Data Analysis, macros, and best practices in data architecture/modeling to build concise worksheets that roll up effectively with each other, I finally stepped into the realm of “advanced Excel skills.”

I recommend learning these functions to build your Excel toolkit; you can find tutorials on YouTube or in-depth courses like from CorporateFinanceInstitute.com.

4. Business acumen and curiosity

My boss told me I had an “appetite” for learning which he also diagnosed as ADHD. He might be right.

This is a difficult skill as it is more of a personality trait.

In short, learn when to stop thinking like an accountant and think like a business person instead.

You are on the right track if you have an entrepreneurial spirit. If you do not, then you will need to gain some more exposure around those that do (i.e., management and executives), listen to some podcasts (After Hours is my favorite), and learn best practices from any available resources (Big 4 and MBB publications are good reference points).

5. Mentorship and executive buy-in

This is the luck of the draw and more of a mix of networking skills and good timing.

After about nine months as a Senior Accountant, building up my work experience, Excel skills, and business acumen, I was called upon by the CFO to assist with building the following year’s budget process.

He said that he and our group’s CEO wanted interactive financial statements that were dynamic and flexible enough to come up with several variations of a budget in 1-hour meetings. With all inputs on headcount, Revenue, COGS, OPEX, CAPEX, financing, and some goal-seek macros, they developed up to 5 versions of a budget per meeting.

After this, I was called for several weekly ad-hoc reports and their impacts on the three financial statements. More and more of this “summoning” from the CFO triggered a push for me to be his direct report as a Senior Financial Analyst, and I realized…. hey, I am doing financial planning & analysis, and I love it!

Because of the nature and privilege of the information I had to analyze, I could not have made it into those executive meetings or run the numbers on top-secret deals without executive buy-in.

Great mentors can accelerate your career faster than fancy titles and years of experience. I learned that my mentors near retirement have 40 years of experience versus my four years of experience. Essentially they have worked my career ten times over! Their wisdom and criticisms mean the world to me, and I appreciate every interaction to make me a better professional.

I will share some of those pearls of wisdom or things I taught myself in future posts on this blog.

These five things helped me break into FP&A from Big 4 Audit.

My career goals are now: Audit Associate > Senior Accountant > Senior Financial Analyst > Finance Manager > Director of Finance > CFO.

I am currently a Senior Financial Analyst and openly applying for SFA and FM roles.